Gold At Spot Price – Gold is a precious metal that draws the attention of everybody. Everybody wants to own a gold in bars, coin, bullions, jewelries, automobiles, gadgets and furniture but can they afford it?

How does the gold pricing work? What should you consider when looking for the spot price? Where do I get the best deals from? What does Gold Spot Price even mean? These are the questions we will answer in the course of our conversation.

What Does Gold Spot Price Mean?

When you see a fancy and glowing item like gold, the first thing that comes to your mind is how much does it cost? The second question is can I afford it? The last question will be can I get it anywhere at a cheaper rate? There is a standard measurement for every substance.

As liters is to petrol, oil and other liquid substances, kg to most solid substance. The S.I unit for measuring gold is ounce. Dollars is the currency used to trade gold all over the world.

The spot price is in dollars and the spot amount is one troy ounce of gold. The spot price of gold is the price at which gold can be bought and delivered immediately. This is different from future contracts where you purchase and receive your delivery at a later period.

Gold at spot price is the highest amount that a consumer of gold can pay to purchase at that point to own a gold and get it delivered to them immediately. There is a market for gold features market where gold and other future contract is traded.

It is known as the Comex. It is most active exchange market for gold. It is the safest and most reliable place to get gold at a spot price.

What Is The Difference Between Gold At Spot Price And Gold At An Actual Price?

The difference between purchasing gold at a spot price and gold at normal time is the form of the gold.

Gold at spot price is for gold in it is raw state i.e the gold has not yet been refined. Buying gold at its actual price is buying physical refined gold. Buying gold at its actual price is slightly higher than buying gold at its spot price because the physical gold has been refined and probably converted to gold bars or coins.

The extra cost attached to the actual price is the cost used to refine the gold into its finished state. Buying at spot price depends on your use for gold and also depending on who you purchased it from.

Gold in form of bullions, coins and bars are manufactured by the government or minting companies. They are sold to dealers who sell to sub dealers but to be a direct dealer with the government and minting is very difficult. It requires certain requirements and funds which most people don’t have.

The direct dealers get gold below the spot price because they are buying at source. The spot price helps maintain the price of gold. It prevents sub- dealers from waking up one morning and increasing the price of gold.

There are times when gold are sold above the spot price but there are factors that prevents the gold from being sold at the spot price. They are known as dealer markups.

How Does Dealer Markups Affect The Spot Price? [Gold At Spot Price]

The sole aim of every one wanting to be a dealer is to make profit. The dealers and sub-dealers goal is to buy gold at a certain price, mark up the product and then sell the product to make profit. There are cost associated with every dealer that could prevent gold from being sold at the spot price. They include:

- Labour: The cost of employing both human and machine labour for carrying out operations such as organizing, keeping and transport the gold from where it is purchased to where it is needed by a consumer.

- Customer Service: It is always at a price. How fast does the customer want their gold? Where do they want the gold to be brought to? How much will it cost to get all these services? All the answers to these questions depends on how much extra you are willing to pay.

- Storage: The dealers always have to own or rent a secured facility where they will keep their purchases and these all cost money. It will therefore affect the price at which gold is sold.

- Marketing: The dealers have to draw the attention to the public that they sell gold through adverts on websites, radios and television stations.

- Transportation and Insurance: The dealers most times are in different countries and they need to ship their gold down to their base. The uncertainties of what could happen to their product makes them indemnify their gold giving them a life line if anything happens to it. All these cost money.

=>> To know what ETF Gold Bullions is about – Click here

There are many other factors that could prevent gold from being sold at its spot price. Normally before setting the spot price, all these factors and more are considered. All the costs are taking into consideration but at times things like drop in value of the currency or recession may lead to the increase of all the dealer markup.

Here are the => Top Gold IRA Companies

What Affects The Spot Price Of Gold?

There are factors that increase or decrease the spot price of gold being sold. This will make the gold itself to be more costly irrespective of all the factors leading to the movement and processing of gold from where it is gotten to the final consumer. They include the following:

- Economic Uncertainties: Many factors affect the stability of the economy including political decisions, national crisis, climate change, epidemics and pandemics like the Covid-19 virus tends to propel the price of gold. This is good news for gold owners while it is bad news for people with stock, shares and bonds because the value of gold appreciates during these times.

- The Value of The United States Dollars: The official trading currency for gold is the USD. Any factor affecting the value of the USD will also affect the price of gold. This can go two ways, it can either be favourable if the value of the currency increases or tragic if the value of the currency reduces. It is always good to monitor the stock exchange and forecast the future value of the currency. It enables you invest smartly.

- Stock Market Activity: It is almost impossible for both stocks and the price of gold to rise together. This is because gold works against the stock exchange market i.e they are inversely proportional. The fall in value of shares and bonds in the stock exchange market will lead to an increase in the value of gold.

- Inflation: The value of gold works inversely proportional against inflation. The rate of inflation in the world right now is high. It is very wise to invest now because of all the instabilities for seen ahead that could lead to inflation.

- Interest rates: Factors that are unfavourable to stocks, bonds and shares are favourable to gold including interest rates.

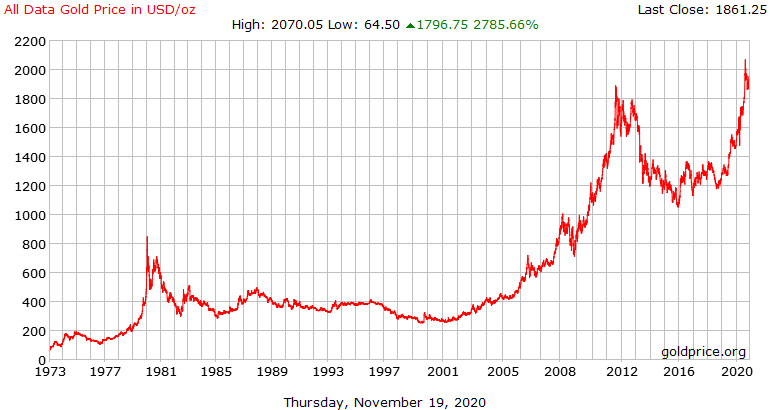

Source: Goldprice.org

What is the Current Spot Price of Gold Today?

The gold price per ounce has gone up compared to the earlier periods of 2020 before the pandemic. The economic effect of the pandemic has led to the rice of the price of gold.

At 28th February, 2020 the price of gold per ounce was $1,564, today the price per ounce is about $1,859.99.

There is a difference of $295.99 which means the price has gone up. Forecasting of future happenings can help you dictate the price of gold. The United States of America’s Election and a possible change of government.

You can read => How Much Gold Should I Have In My Portfolio

The actions of the prospective new president to reduce and possibly eradicate the corona virus will possibly lead to another lockdown and reduction in economic activities. This may affect the price of gold and may motivate people to invest more.

Our Recommended Companies to help You Purchase Your Gold Precious Metal

We highly recommend two companies, which are –

- Augusta Assets Company.

- Bullion Vault Company.

If you want to relax and Let the Company perform all the work for you then – you can make use of Augusta Assets Company. Click the Button Below to get access to Augusta Assets.

Or If You decide to purchase yours quickly by using your mobile phone or Laptop then – You can easily get access to the Bullion Vault Company. Click the button below to Open a Bullion Vault Account and Purchase Yours Instantly.